In case PAN details are not provided then the rate is 34608. Before applying for withdrawal under this scheme EPF members are required to check the balance in Account II and obtain a letter from EPF that specifies the amount that can be withdrawn.

Epf Partial Withdrawal Allowed Under These Conditions Business News

Surat pengesahan pendaftaran pelajar.

. EPF Withdrawal for Education Including PTPTN. This is a unique loan as you dont need to return the same. If you meet this condition you can follow the procedure given below to withdraw your EPF online.

Borang KWSP 3 Pindaan untuk penghantaran melalui pospengesahan cop ibu jari gagal. V02112021 KWSP 9H AHL PERCUMA 20 PERHATIAN DAN MAKLUMAN KEPADA PEMOHON 21 Pengajian di IPT Luar Negara 211 Surat Tawaran Belajar Surat Pengesahan Pendaftaran Pelajar dan resit bayaran hendaklah. This is because early withdrawals from the EPF are not a part of the tax-deductible income of the employees.

Withdrawal from Account 2 to fund own or childrens education. Step 2- From the top menu bar click on the Online Services tab and select Claim Form-31 1910C 10D from the drop-down menu. Medical Emergency 2Childrens Higher Education 3Marriage SelfSiblingsChildren 4.

14 PF Withdrawal for construction purchase of houseland Paragraph 68B. Contents hide 1 EPF Partial Withdrawal Rules 2020. It means if youre getting your daughter admitted to a college and you need money for her college fees.

So the salary you receive on hand comes after the deduction of PF. 12 months basic wages and DA OR Employee Share with interest OR Cost Whichever is least 1 One 1ONE Member Declaration Form from Member II Para 68BB. A For refund of outstanding principal and interest of a loan for purposes under Para.

This income of Employee comes under 80C section of Income-tax act. Withdrawal from the fund for repayment of loans in special cases. This rate always remains higher than PPF or any fixed-income funds.

EPF withdrawals before five years of continuous service attract TDS. Partial PF Withdrawal Rules for. We will cover the following topics.

You can even take a loan against your employees provident fund EPF for the education of your kids. It is treated more like a withdrawal from the corpus that gets accumulated month-on-month and year-on-year. Sila hubungi Pusat Pengurusan Perhubungan KWSP 03 8922 6000 untuk sebarang pertanyaan berkaitan permohonan ini.

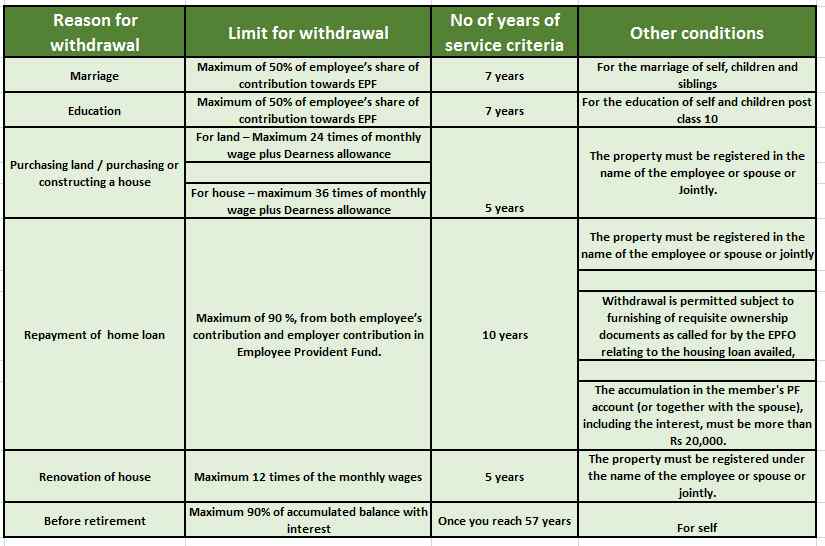

EPF Withdrawal Rules - Partial and Full in 20211. While it is possible to withdraw the EPF corpus before retirement it is still advised that you do not do so. For Marriage or Higher Education.

As part of the application process for the special withdrawal facility of RM10000 the Employees Provident Fund EPF will open the application to persons under the age of 55 beginning 1 April 2022 after. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Online EPF withdrawal requests can be settled within 15 to 20 working days from the date of submitting the request.

The applicable TDS rate is 10 on withdrawals if the PAN details are furnished. Before 5 Years of Service. Yet its applicable in the case of higher education only.

Salinan dokumen pengenalan bersama yang asal untuk tujuan pengesahan untuk bukan pemegang MyKad sahaja Surat kelulusan pengiktirafan kursus pengajian. Withdrawal under sl no e above. For the previous financial year 2020-2021 the interest rate is 85 In the fiscal year 2019-2020 the interest was 865.

It can be your sibling or brothersister. 12 PF Withdrawal for Education Paragraph 68K. Thus youre eligible to withdraw.

With that in mind the EPF allows you to. Step 1- Sign in to the UAN Member Portal with your UAN and Password. You can also withdraw your EPF amount for educational purposes.

If the withdrawal amount is less than INR 50000 then no TDS is cut. An employee can also withdraw the EPF amount for his sons or daughters higher education needs. Interest rates are confirmed by them every year.

5 crore workers registered under Employee Provident Fund or EPF to get non-refundable advance of 75 of the amount or three months of the wages whichever is lower from their accounts. 13 PF Withdrawal for Medical Treatment Paragraph 68J. Tertiary education is exceptionally expensive these days and while PTPTN has done a good job of assisting those who need help with paying for tuition fees it may be difficult to immediately repay your study loan in the years after you start working.

Only 50 of the PF amount can be withdrawn for child higher education after matriculation or marriage of a family member who is financially dependent on you like younger siblings or children. We will look into partial PF withdrawal rules on education health and marriage. The privilege of this benefit can be availed 3 times in a lifetime.

The conditions for the withdrawal are as follows. Members can apply by completing the KWSP 9H AHL form and submit together with supporting documents. 11 PF Withdrawal for Marriage Paragraph 68K.

Borang KWSP 9H AHL dan Senarai Semak Dokumen. When Can Withdraw Epf.

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Financing Your Studies Through Epf

Rm10 000 Epf Special Withdrawal Everything You Need To Know Soyacincau

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

How To Withdraw Epf Online Indianmoney

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Online Epf Claim Facility Procedure Process Flow Conditions

How To Apply For Epf Withdrawal From Account 2 For Education Eduspiral Consultant Services Best Advise Information On Courses At Malaysia S Top Private Universities And Colleges

Pf Withdrawal Process Online 2021 Pf Advance Limit And How Many Times Advance Pf Can Be Withdrawn Youtube

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Pf Money Withdrawal Step By Step Guide To Do It Online Provident News India Tv

Epf Withdrawal Rules When And For What You May Withdraw Your Epf

Epf Withdrawal Utilise The Savings Wisely Imoney

Covid 19 Know How Much You Can Withdraw From Your Epf

How To Withdraw Employees Provident Fund Epf Online Sure Job

Pf Advance Withdrawal For Education And Marriage Eligibility And Procedure Youtube

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Partial Withdrawal Or Advance Process Form How Much

Epf Withdrawals New Rules Provisions Related To Tds

- obat jerawat kimia farma

- mata wang malaysia ke korea

- undefined

- epf withdrawal for education

- kelebihan kelenjar pituitari

- gambar pisang tanduk goreng

- jenis-jenis pisau dapur dan kegunaannya

- ktm duke 125 finance price

- warna cat dalam rumah sederhana

- video game i player

- gaya rambut pendek perempuan terkini

- huawei y9 prime usb

- kepentingan bahasa melayu sebagai bahasa kebangsaan

- jenis tanaman hias vertikal

- logo yayasan negeri sembilan

- public bank forex rate

- deco raya tradisional

- pengisytiharan kemerdekaan tanah melayu

- gambar hotel genting highland

- desain kamar tidur perempuan keroppi